Excerpt: “The mine property, which stretches from Tamaqua east to Coaldale, Lansford, Summit Hill and Jim Thorpe, has more than 300 million tons of reserves.”

When New York investment manager Doug Topkis bought an 8,000-acre coalfield near Tamaqua in bankruptcy court two years ago, he didn’t know anthracite from bituminous.

He does now.

Rebuilding a Pennsylvania coal business in the age of alternative fuels and in the shadow of the state’s booming Marcellus natural gas production has proved to be an education in energy, logistics and global economics.

Topkis, and his father-in-law, auto-sales and housing mogul Bruce Toll, of Philadelphia, had loaned money to the former Lehigh Coal & Navigation Co., which went belly up in 2008, steeped in debt, unable to pay its bills, and the object of 24 state environmental infractions for failure to restore mine pits and treat acid water drainage.

To recover their money, Topkis and Toll bid at the bankruptcy auction for the historic mine property that sprawls across five towns in Schuylkill and Carbon Counties, home of the 19th-Century’s Molly Maguires, one of the first labor movements in this country.

The sale was for $14.8 million “and we were owed a little more than that,” recalled Topkis, who quit his small investment fund, Haystack Capital L.P., to become a hands-on, full-time owner.

The surface mine, called Lehigh Anthracite, got its name because its coal used to go by barge down the Lehigh River. The Lehigh brand is known around the world as premium anthracite, with few impurities, low sulfur, high carbon, and ultralow volatility.

Anthracite coal burns cleaner and hotter than other commercial coal, and is in demand for water filtration, home heating, steelmaking, and in some power plants.

The mine property, which stretches from Tamaqua east to Coaldale, Lansford, Summit Hill and Jim Thorpe, has more than 300 million tons of reserves.

When Topkis arrived on June 3, 2010, “you could hear birds and there was dead silence. It was a very scary time. The mine was idle. There was nothing here.”

The company has since grown to more than 90 employees, and is on track to produce 500,000 tons of coal this year.

“Whatever we can mine, we have customers buying it,” said the Abington native and Wharton School grad, who is married to Toll’s daughter, Wendy, whom he met at the University of Pennsylvania.

Topkis said he and Toll partnered with Robindale Energy Services, of Armagh, Pa., and hired Rusty Taylor, Robindale’s vice president of environmental and regulatory matters, to run the operation.

With Robindale on site, “we were able to gain instant credibility,” Topkis said. “Because of the bankruptcy and the environmental issues, we couldn’t get a vendor to show up. They wanted cash on delivery because people hadn’t been paid and no one trusted what was here and people didn’t know who we were.”

Before putting a shovel in the ground, the owners posted a $10.6 million bond with the state to pay for filling in large mining pits and planting greenery.

Tens of millions have been spent on equipment, revamping the plant and offices “and all the other stuff we had to acquire, probably a little less than $100 million,” he said. “It’s a long-term play.”

Coal and export markets will fluctuate, “but if we build a nice business around great people, the resources are here,” Topkis said. “Over the next many years we’ll get a nice return, but it’s not going to be instant.” He said he provides his father-in-law with a daily update.

Kevin Sunday, spokesman for the state Department of Environmental Protection, said the new operators are actively working on remediation. “We’re seeing improvement at the site. These are surface mines, but you still have pits in the ground. The rain water moves through it, and as the water drains through the site it becomes acidic.”

As miners finish one job and move on, they are supposed to clean up. “The previous operator was running out of funds to do that,” Sunday said. Lehigh Anthracite established a trust fund to treat all the acid mine drainage “in perpetuity. Between the bonds and the trust fund, they put up $24.5 million to make sure the site stays clean,” he said.

Although coal tends to get lumped into one category, the type that fires most electric-generating plants and is the focus of much environmental concern, is bituminous, or soft coal, and not anthracite, which is a hard coal, sometimes called “black diamond,” that burns cleanly with little soot.

Pennsylvania is the fourth-largest coal producing state in the nation. It produces 59 million tons a year of bituminous coal, and less than 2 million tons of anthracite, which accounts for about two percent of U.S. coal reserves.

Five counties in northeastern Pennsylvania produce some of the best-quality anthracite in the world. “Right now, the market for it is really good,” said Duane Feagley, executive director of the Pennsylvania Anthracite Council.

Lehigh’s anthracite fetches $150 to $200 a ton. The company expects $60 to $80 million in revenues this year.

U.S. steel plants are buying it to substitute for coke used in steel making. Anthracite doesn’t replace coke, but it can be mixed in to reduce total coke use in a steel mill, said Taylor, who runs the mine.

Customers use it for home heating in Spain and for silicon-metal making in Norway. It’s also going indirectly to China and India. “We sell it to someone who has the logistical ability to deliver it cheaper than we can,” Topkis said. “Our goal is to go direct to the end customer. It just takes time.”

The mine allocates a portion of tonnage annually to heat local homes, and for the neighboring Xylem Inc., a water purification company in Watsontown. Another 15,000 to 16,000 tons a month of “waste” or scrap coal goes to Panther Creek Partners, which generates electricity for PJM Interconnection, the regional power grid.

The anthracite leaves the mine, after being washed and crushed to the customer’s specification, by rail and truck, connecting to other trains, barges, or oceangoing ships in Fairless Hills, Bucks County, and Baltimore.

The Philadelphia Regional Port Authority was interested in Lehigh Anthracite exporting coal from Pier 124 in South Philadelphia. But the deal didn’t happen because land and rail access was needed from Norfolk Southern Railway, which wanted to keep it for another potential use.

“We are looking at piers all up and down the coast and throughout the City of Philadelphia specifically,” Topkis said. “We’re not there yet. It’s more in the event that we really start to ramp up here.”

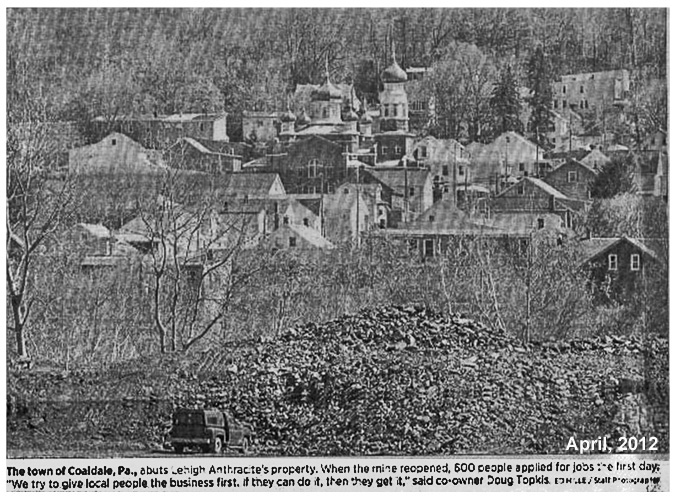

When the mine reopened, 600 people applied for jobs the first day. About 90 percent of the workers hired live within a 20-mile radius, Taylor said.

“We try to give local people the business first. If they can do it, then they get it,” Topkis said. “If they can’t, for whatever reason, maybe they don’t have the equipment, then we’ll go out a little farther in terms of geography. Our philosophy has been local talent is fantastic. They have supported us. We are supporting them.”

Tamaqua Borough Council president Micah Gursky said the new operators have been “a welcome breath of fresh air.” The town’s past, present, and future is tied to the coal industry, he said.

“It’s nice to have responsible owners, who are doing the right thing, hiring people again, addressing some of the long-standing issues, and paying their water bill, their sewer bill, and their taxes. It means a lot for the community. We’re a small town of 7,000 people.”

Topkis’ role is to plan for the future. He said he’d like to potentially build a second coal processing plant east toward Jim Thorpe. The mine could then produce 1 million tons a year.

“With several hundred million tons of reserves, the opportunity is here to really grow internally by spending money on this site,” he said. “Adding people, adding equipment, and adding a processing plant. We have a real nice opportunity ahead of us, assuming that the markets cooperate.”

Contact Linda Loyd at 215 854 2831 or lloyd@phillynews.com.

Source: Click me